What is DeFi? Beginner’s Guide to Decentralized Finance

For centuries, finance has operated through centralized intermediaries: banks, brokers, and clearing houses. These institutions control who can participate, the fees they pay, and the rules of the game. However, a new paradigm has emerged, promising to reshape how we save, invest, lend, and trade: Decentralized Finance (DeFi).

DeFi is a revolutionary, global movement that leverages blockchain technology to build an open-source, permissionless, and transparent financial system. At its core, it aims to cut out the middlemen, granting users direct control over their assets and opening up complex financial tools to anyone with an internet connection. It is often referred to as “TradFi” (Traditional Finance) 2.0, not just optimizing the existing system but rebuilding it from the ground up.

If you’re hearing about DeFi protocols like Aave, Uniswap, and Compound and feeling lost, this comprehensive guide will break down the fundamental concepts, explain how this ecosystem works, and prepare you to take your first steps into the future of money.

Understanding the Core Principles of DeFi

The term “DeFi” represents a suite of applications built primarily on smart contract-enabled blockchains, with Ethereum being the largest and most established ecosystem. Unlike banks, which rely on trust in an institution, DeFi relies on trust in code, executed automatically by a smart contract.

The principles defining this new financial frontier are crucial to understanding its disruptive potential:

Non-Custodial & Permissionless

The most significant shift in DeFi is the concept of non-custodial ownership. When you deposit money in a bank, the bank is the custodian of your funds. In DeFi, you remain the sole custodian of your assets using a non-custodial crypto wallet (like MetaMask or Trust Wallet). This embodies the phrase: “Not your keys, not your crypto.” Since no central authority controls the protocols, anyone, anywhere in the world, can access DeFi applications without needing to complete lengthy Know Your Customer (KYC) forms or geographical restrictions.

Transparency and Composability

Every transaction in the DeFi ecosystem is recorded on a public blockchain ledger. While user identities are typically pseudonymous (represented by a wallet address), all transactions, balances, and smart contract code are verifiable by anyone. This level of transparency is unprecedented in traditional finance.

Furthermore, DeFi protocols are designed to be “composable,” often referred to as “money Legos.” This means one protocol can easily integrate with another. For example, you can take a loan from Protocol A, use the borrowed funds to provide liquidity on Protocol B, and then use the resulting liquidity tokens as collateral on Protocol C. This interoperability fosters incredible innovation and capital efficiency.

The Key Pillars of the Decentralized Finance Ecosystem

The applications within the DeFi ecosystem are broad, covering nearly every service offered by a bank, but in a non-custodial, peer-to-peer manner.

Decentralized Exchanges (DEXs)

DEXs are platforms that allow users to trade cryptocurrencies without needing a centralized intermediary. Unlike Coinbase or Binance, DEXs like Uniswap and SushiSwap operate using Automated Market Makers (AMMs). An AMM relies on liquidity pools—funds contributed by users called “Liquidity Providers” (LPs)—to facilitate trades. When a user trades, they swap tokens directly with the pool, and LPs earn a small fee from every transaction.

Lending and Borrowing Protocols

Platforms like Aave and Compound allow users to lend their crypto to earn interest or borrow crypto by providing collateral. The interest rates are determined algorithmically based on the supply and demand for that asset within the protocol’s liquidity pool. Importantly, most borrowing in DeFi is over-collateralized, meaning you must deposit more value than you wish to borrow to ensure the loan can be repaid even if the collateral asset’s price drops.

Stablecoins

Stablecoins are cryptocurrencies pegged to a less volatile asset, most commonly the US Dollar (USD). They are the essential bridge between the volatile crypto market and the traditional economy. Stablecoins are used widely in the decentralized finance space to facilitate lending, borrowing, and yield farming strategies without being subject to extreme price swings. Examples include MakerDAO’s DAI (algorithmic) and Circle’s USDC (fiat-backed).

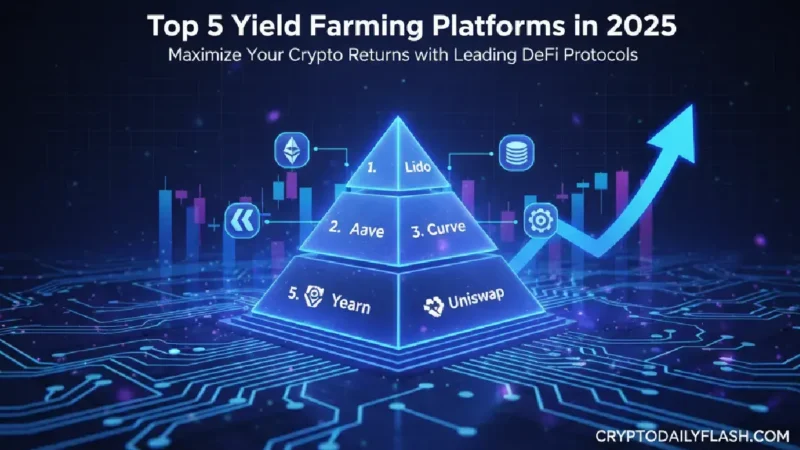

Yield Farming and Staking

Yield farming is the practice of strategically moving crypto assets between various DeFi protocols to maximize returns, often involving providing liquidity or staking tokens in governance protocols. It is essentially the hunt for the highest “yield.” Staking, another core activity, involves locking up tokens to secure a Proof-of-Stake (PoS) blockchain network, and in return, users receive rewards.

Insurance and Synthetic Assets

The ecosystem also includes insurance protocols (e.g., Nexus Mutual) that offer coverage against smart contract failures or hacks. Synthetic assets are tokens that derive their value from another asset, such as a stock, commodity, or even fiat currency, allowing investors to gain exposure to these traditional assets without ever leaving the blockchain environment.

The Compelling Benefits of Decentralized Finance (DeFi)

The growth of this movement is fueled by several powerful advantages over traditional financial systems:

- Financial Inclusion: For the 1.7 billion adults globally who are unbanked, DeFi offers a direct, digital gateway to financial services using just a smartphone and an internet connection.

- Lower Costs: By removing costly middlemen (banks, brokers, payment processors), the operational costs are dramatically reduced, leading to lower fees for the end-user.

- 24/7 Global Access: Financial markets are always open. Regardless of your time zone or national holidays, you can trade, lend, or borrow instantly.

- True Ownership: Users are the sole holders of their private keys, giving them absolute authority over their funds, free from government seizure or bank interference.

The principles guiding decentralized finance ensure that capital markets are efficient and accessible.

Navigating the Risks and Challenges

While the promise of DeFi is immense, newcomers must be aware of the inherent risks:

Smart Contract Risk

The code is law in DeFi. If a smart contract contains a bug, it can be exploited by hackers, potentially leading to the loss of all funds locked in that contract. While audits are standard practice, they do not guarantee invulnerability.

Impermanent Loss (IL)

This risk applies specifically to users who provide liquidity to AMM pools. Impermanent Loss occurs when the price of the assets deposited in a liquidity pool changes compared to when they were deposited. The loss is “impermanent” because it only becomes permanent if the LPs withdraw their funds. This is a crucial concept to master before engaging in liquidity provision.

Regulatory Uncertainty

Because decentralized finance is a nascent and highly disruptive technology, global regulatory frameworks are still catching up. Future regulations could impact how certain protocols or tokens operate, which represents a systemic risk to the entire ecosystem.

Getting Started with DeFi: A Beginner’s Checklist

If you are ready to explore the world of decentralized finance, here is a simple and safe path to get started:

- Choose a Non-Custodial Wallet: Install a reputable browser extension or mobile wallet like MetaMask or Rainbow. This wallet is your portal to the DeFi ecosystem.

- Acquire a Base Asset: You will need the native token of the blockchain you are using (e.g., Ether (ETH) for Ethereum) to pay for transaction fees (Gas). You should also acquire a stablecoin like DAI or USDC, which are foundational assets in many decentralized finance strategies.

- Start Small with Simple Staking: Begin by staking a stablecoin in a highly audited and reputable lending protocol. This is one of the safest ways to earn a yield while minimizing exposure to volatile assets and complex smart contract interactions.

- Practice on a Layer 2 Network: To avoid high transaction fees on the main Ethereum network, consider using a Layer 2 scaling solution (like Polygon or Arbitrum). These networks provide the same functionality as the main chain but with significantly lower transaction costs.

- Educate Yourself Continually: The decentralized finance space evolves daily. Never invest funds you cannot afford to lose, and always research a protocol’s audit history and team before committing your assets.

The future of decentralized finance promises a world where financial services are available to everyone, everywhere, at the speed of the internet. By understanding the fundamentals and approaching the space with caution and curiosity, you can participate in the largest financial transformation of the 21st century. Navigating the world of decentralized finance requires due diligence. The innovation driven by decentralized finance protocols is astounding.

Stay informed, read the latest crypto news in real time!

Conclusion: The Future is Open

Decentralized finance represents more than just a new way to earn interest; it’s a philosophical movement challenging the established, top-down structure of traditional banking. The shift from a closed, trust-based system to an open, code-based system is profound. While risks exist, the promise of greater inclusion, transparency, and personal financial sovereignty makes DeFi one of the most exciting sectors in the entire Web3 space. The growth trajectory for decentralized finance suggests we are still in the early stages, making education and cautious participation the best strategy for beginners today.