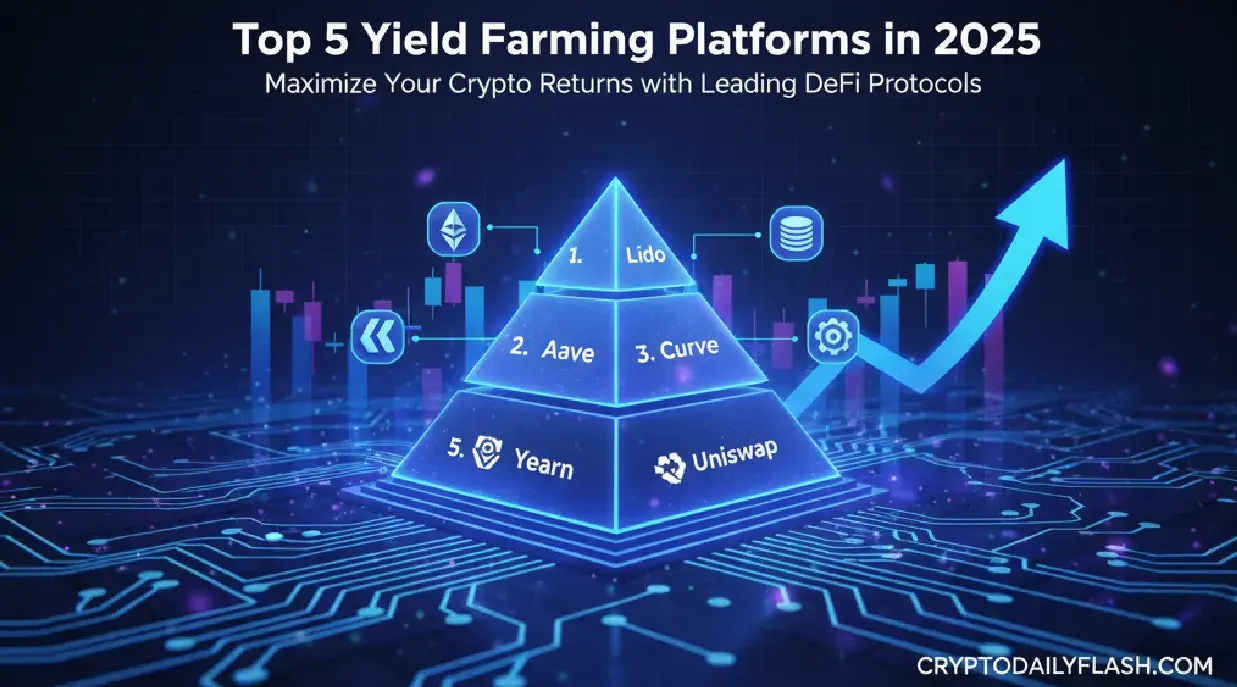

The Ultimate Guide to the Top 5 Yield Farming Platforms in 2025

The world of decentralized finance (DeFi) has matured far beyond its nascent days. In 2025, it represents a robust, multi-chain financial ecosystem that has attracted billions in total value locked (TVL). For crypto enthusiasts and investors seeking to maximize their digital asset returns, understanding the best platforms for passive income is essential. The practice of liquidity provision and asset lending—often referred to as yield farming—has become highly sophisticated, with protocols continually innovating to offer better efficiency and security.

This guide delves into the top five decentralized platforms dominating the space in 2025, offering a breakdown of their primary services, unique advantages, and how they stack up in the competitive decentralized finance arena.

From Vanilla Pools to Automated Vaults

Early DeFi strategies primarily involved depositing two tokens into a decentralized exchange (DEX) to earn trading fees. Today, the landscape is segmented into specialized verticals: lending and borrowing markets, liquid staking providers, automated aggregators, and highly specialized exchanges. The focus has shifted from chasing unsustainable annual percentage yields (APYs) to optimizing capital efficiency, leveraging multiple layers of protocols, and ensuring security through robust smart contract audits.

The Rise of Liquid Staking Tokens (LSTs)

A major trend solidifying in 2025 is the dominance of Liquid Staking Tokens (LSTs), particularly on the Ethereum network. LSTs allow users to stake their Proof-of-Stake assets (like ETH) to secure the network and earn staking rewards, all while receiving a tokenized, liquid derivative (like stETH) that can be used elsewhere in the DeFi ecosystem. This effectively allows users to earn staking rewards and simultaneously deploy their liquid assets into other decentralized finance strategies, creating a powerful compounding effect that has become a cornerstone of modern wealth generation in the space.

Top 5 Platforms for Yield Generation in 2025

The following platforms represent the leading edge of innovation, security, and TVL in 2025. They offer diverse avenues for earning passive income and are considered the most reliable choices for sophisticated decentralized finance strategies.

1. Lido Finance: The Liquid Staking Titan

Lido Finance has cemented its position as the largest protocol in decentralized finance by TVL, driven by its domination of the liquid staking market.

The LST Advantage

Lido allows users to stake assets like Ethereum (ETH), Polygon (MATIC), and Solana (SOL) without locking up their funds or running complex validator nodes. When a user deposits ETH, they receive stETH (staked ETH) in return. This stETH token accrues staking rewards daily and, critically, remains liquid.

This dual-utility is what makes Lido a powerhouse. Users can take their stETH, which is already generating staking returns, and use it as collateral in lending protocols like Aave (covered next) or provide it as liquidity on DEXs. This layering of returns is a prime example of advanced passive income generation and is a main reason Lido continues to attract massive capital.

Key Features:

- Liquid Staking: Earn staking rewards instantly and keep your assets available.

- Security: Highly audited, community-governed DAO structure.

- High Composability: stETH is widely integrated across the entire decentralized finance ecosystem.

2. Aave: The Multi-Chain Lending Hub

Aave is one of the most foundational and time-tested protocols in decentralized finance, operating as a decentralized lending and borrowing platform. Its resilience and expansion across multiple Layer 1 and Layer 2 networks (such as Ethereum, Polygon, Avalanche, and Base) ensure it remains an indispensable tool for investors.

Earning and Borrowing

Investors can deposit a wide range of cryptocurrencies and stablecoins into Aave’s liquidity pools to earn competitive, variable interest rates. These deposits serve as the backbone for borrowers who can take out over-collateralized loans. The interest paid by borrowers is distributed among the depositors, creating a straightforward passive income stream.

Aave is also famous for pioneering Flash Loans, a highly technical feature that allows for non-collateralized borrowing, provided the loan is repaid within the same blockchain transaction. While complex, Flash Loans are a key tool for arbitrage and sophisticated automated strategies.

Key Features:

- Lending & Borrowing: Earn interest on deposits or borrow against collateral.

- Flash Loans: Innovative tool for advanced arbitrage and financial operations.

- Multi-Chain Support: Broadest reach across major blockchain networks, increasing accessibility and liquidity.

3. Curve Finance: Stablecoin Efficiency and CRV Boosts

Curve Finance is a specialized decentralized exchange (DEX) designed primarily for swapping stablecoins (like USDT, USDC, and DAI) and other pegged assets (like different versions of tokenized BTC). Its unique Automated Market Maker (AMM) algorithm minimizes slippage, which is crucial when exchanging two assets that should have roughly the same value.

The Role in Liquidity Generation

For those interested in stablecoin-focused yield farming, Curve is the premier destination. Its specialized pools offer some of the highest and most capital-efficient returns for stablecoins. Furthermore, the platform’s governance token, CRV, can be locked to receive veCRV (vote-escrowed CRV). This allows liquidity providers to “boost” the rewards they receive from their liquidity pools, incentivizing long-term commitment and deeper liquidity. This powerful reward-boosting mechanism has created an entire sub-ecosystem of protocols, like Convex Finance, built on top of Curve, dedicated to maximizing these incentives.

Key Features:

- Low-Slippage Swaps: Optimized for pegged assets like stablecoins and LSTs.

- CRV Boosting: Advanced mechanics to maximize rewards for long-term liquidity providers.

- High Stablecoin APYs: A reliable source of returns with lower risk of impermanent loss compared to volatile crypto pairs.

4. Yearn Finance: Automated Yield Aggregation

For investors who want to engage in yield farming but lack the time or technical knowledge to manage complex strategies across multiple protocols, Yearn Finance provides the ideal solution. Yearn is a pioneering yield aggregator, often described as an “auto-pilot” for decentralized finance.

The Power of Vaults

Yearn’s core product is the “Vault.” Users deposit their assets (e.g., ETH, USDC) into a specific Vault, and Yearn’s smart contracts automatically deploy those funds into the most optimal, highest-performing strategy across the DeFi ecosystem. These strategies can involve lending, providing liquidity, leveraging assets, and automatically harvesting and compounding rewards.

The main advantage is convenience and optimization. Yearn constantly monitors hundreds of opportunities and executes transactions on behalf of the user, saving on gas fees (which are split among Vault participants) and maximizing compounded returns by frequently reinvesting profits. For the passive investor, Yearn remains the best-in-class tool for hands-off asset growth.

Key Features:

- Auto-Compounding: Rewards are automatically reinvested to maximize returns.

- Strategy Optimization: Funds are shifted to the best-performing, audited strategies across DeFi.

- Gas Efficiency: Batching transactions helps reduce overall costs for participants.

5. Uniswap: Core Liquidity Provision and Fee Generation

Uniswap is arguably the most recognizable name in decentralized finance. As the inventor of the Automated Market Maker (AMM) model, it remains the dominant decentralized exchange, particularly on Ethereum and major Layer 2 solutions.

Liquidity Provision as Passive Income

The ability to earn money via Uniswap is straightforward: provide two tokens in a liquidity pool (e.g., ETH/USDC) and, in return, receive a share of the trading fees generated by people swapping those assets.

The V3 and upcoming V4 iterations have introduced a highly powerful feature known as Concentrated Liquidity. Instead of having capital spread evenly from a price of zero to infinity, liquidity providers can concentrate their capital within narrow price ranges (e.g., $1,800 to $2,200 for ETH). This allows for dramatically higher capital efficiency and, consequently, higher fee-based returns for the liquidity provider. However, it also introduces a more active management requirement, as the capital stops earning fees if the price moves outside the selected range. For those willing to actively manage their positions, Uniswap provides a direct and fee-rich avenue for liquidity provision.

Key Features:

- Concentrated Liquidity: Enables highly capital-efficient liquidity provision.

- Largest DEX: Unmatched liquidity and trading volume across thousands of token pairs.

- Direct Fee Earning: Earn a portion of every swap that occurs in your pool.

Strategies and Risks: Navigating the DeFi Space

While the opportunities for passive income through specialized protocols are immense, participants must approach these strategies with caution. The decentralized nature of these platforms means there is no central authority to recover funds in case of loss.

Key Risks to Consider

- Smart Contract Risk: All decentralized finance protocols rely on smart contracts. A flaw or bug in the code can lead to a total loss of funds. Mitigation: Only use protocols that have been extensively audited by reputable firms (e.g., Trail of Bits, ConsenSys Diligence) and have a long, successful operational history.

- Impermanent Loss: This is a key risk for liquidity providers on DEXs like Uniswap and Curve. It occurs when the price of deposited assets changes relative to each other, resulting in the asset value being worth less than if the user had simply held the tokens in their wallet. Mitigation: Use stablecoin pools (like those on Curve) or aggressively managed concentrated liquidity positions on Uniswap.

- Liquidation Risk: When borrowing funds (e.g., on Aave), if the collateral asset’s price drops too far, the collateral can be automatically sold (liquidated) to repay the debt. Mitigation: Maintain a very high collateralization ratio and monitor your positions closely.

- Token Risk: Many protocols reward liquidity providers with a native token (like CRV or UNI). The value of this token can be highly volatile, and a sharp drop in its price can negate the overall returns earned from fees and interest. Mitigation: Prioritize strategies that generate returns in more stable assets like ETH or major stablecoins.

Stay informed, read the latest crypto news in real time!

Conclusion: The Future of Decentralized Finance

The year 2025 finds the decentralized finance landscape more competitive, secure, and technologically advanced than ever before. Platforms like Lido, Aave, Curve, Yearn, and Uniswap are not just offering high-APY opportunities; they are building the infrastructure for a fully transparent, programmable financial system.

For investors, the key to success in this environment lies in understanding the core mechanic of each platform: liquid staking for capital efficiency, lending for passive interest, stablecoin pools for low-risk returns, aggregation for automation, and concentrated liquidity for high fee generation. By selecting thoroughly audited, high-TVL platforms and practicing disciplined risk management, investors can confidently navigate the exciting, high-growth opportunities inherent in specialized decentralized strategies. The journey into decentralized asset management offers genuine power and control to the individual, cementing its role as the future of finance.